-

About

-

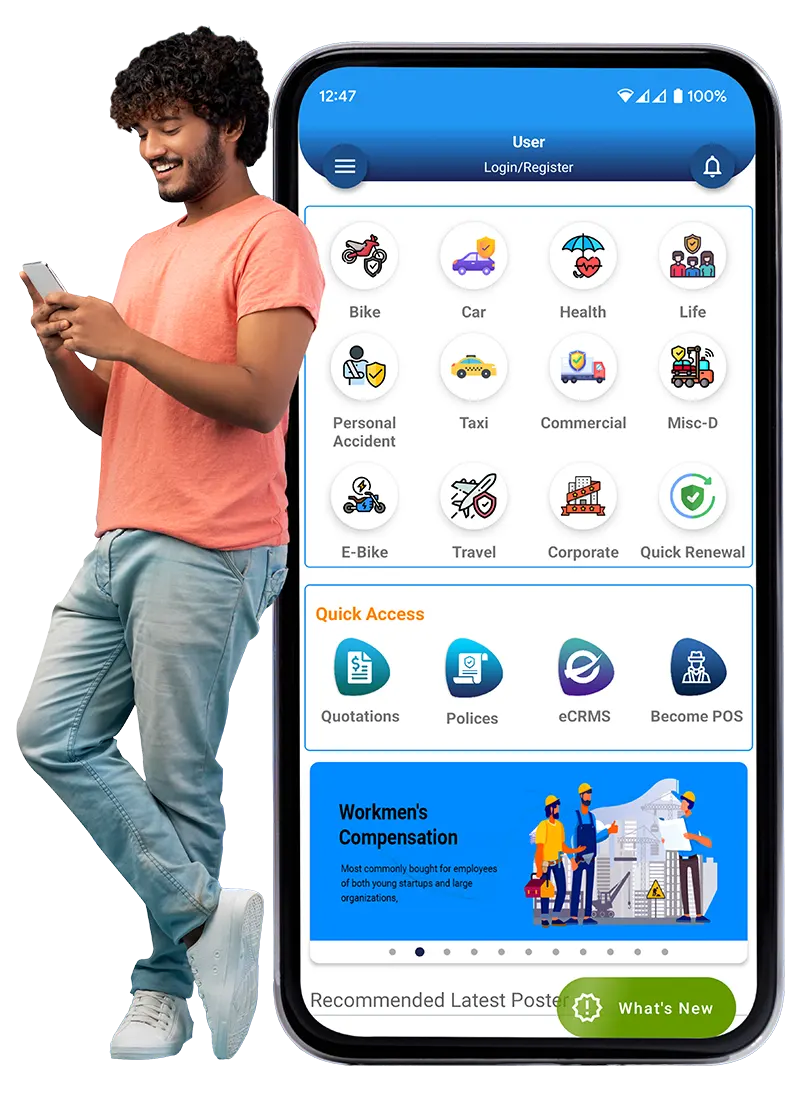

Product

Health Insurance

Car Insurance

Bike Insurance

Life Insurance

Travel Insurance

Property Insurance

Marine Insurance

Best Health Insurance Plans

Health insurance is not a new term in today’s world. Above this, the global pandemic has also knocked on our door to secure ourselves from unwanted situations. This is where healthcare insurance comes into play. This is a mutual agreement between a policyholder and insurance company to offer compensation as a medical expense in case you meet with an accident or get hospitalized.

Car Insurance Online

Car insurance is a policy that protects the financial interests of your vehicle in the occurrence of any unforeseen incidents such as theft, accidents, natural or man-made disasters. A car insurance policy also provides you a financial shield in case of any damage to a third party person or property.

Bike Insurance Online

The law regarding motorcycle insurance in India requires the purchase of a Third-Party Liability Bike Insurance Policy at the very least. These are the requirements outlined in the Indian Motor Vehicles Act. The law requires you to pay monetary penalties if you violate it. Failure to comply can even land you in jail! Moreover, an uninsured bike accident can result in severe legal consequences.

Best Life Insurance Online

Living a tension-free life with your beloved family is the most precious thing everybody wants. People do everything to take care of the emotional and financial needs of their loved ones. Everybody wishes that their family members stay happy, protected, and financially secure throughout their life, and tensions stay far away if anything unfavorable happens.

Travel Insurance Online

An insurance policy that offers financial compensation to the policyholder if something goes wrong while on a trip is known as travel insurance. Vacations, business trips, and educational trips are all covered by travel insurance plans.

Property Insurance Online

It mainly comprises of material value in the form of tangible assets. Since tangible property has a physical shape and consistency, it is subject to many risks ranging from fire, allied perils to theft and robbery. But if a person judiciously invests in insurance for his property prior to any unexpected contingency then he will be suitably compensated for his loss as soon as the extent of damage is ascertained.

Marine Insurance Online

Business is no longer constrained by borders and goods are shipped around the world. It's very crucial to protect these goods from various possible mishaps. Marine Insurance Policy is one of the best cargo insurance covers, which will help you protect your valuable cargo literally anywhere in the world. Our insurance policy will provide full cover against damage or loss to cargo sent by sea, road, rail or air.

-

Insurance Advisors

- Insurance Advisors in JAIPUR

- Insurance Advisors in MUMBAI

- Insurance Advisors in PUNE

- Insurance Advisors in AHMEDABAD

- Insurance Advisors in BANGALORE

- Insurance Advisors in DEHRADUN

- Insurance Advisors in CHANDIGARH

- Insurance Advisors in RANCHI

- Insurance Advisors in BIKANER

- Insurance Advisors in RAJGARH

- Insurance Advisors in KOTA

- Insurance Advisors in SIKAR

Claim

Support

-

Become POSP

-

Contact Us