Extensive Plan Choices

Round-the-Clock Claim Support

Dedicated Expert Guidance

LIC of India

The full form of LIC is Life Insurance Corporation of India, is one of the biggest life insurance companies in India. It was started in 1956 when the Government of India combined many small private insurance companies into one. LIC of India is fully owned by the Indian government and plays an important role in helping people plan for their future.

LIC offers many types of insurance plans like savings plans, term insurance, pension plans, health insurance, and group insurance. These plans help people save money, protect their families, and feel financially secure.

LIC of India is trusted by millions of people and has a large network of offices and agents across the country. It is known for its strong financial background and for quickly settling claims when needed.

In 2022, LIC launched its IPO (Initial Public Offering), allowing the public to buy shares in the company. Even after this, the government still remains in control. LIC also works in some other countries and continues to grow.

Key Highlights of LIC of India

| Highlights | Details |

|---|---|

| Full Name | Life Insurance Corporation of India |

| Founded | 1 Sept 1956, merging 245 private insurers |

| Ownership | Fully owned by the Government of India |

| Headquarters | Mumbai, Maharashtra |

| Solvency Ratio (Mar 31, 2025) | 2.11 - well above IRDAI's 1.5 minimum |

| Gross Written Premium (FY 2024-25) | ₹4.88 lakh crore |

| Total Premium Income (FY2025) | ₹4.88 lakh crore (includes individual & group) |

| Profit After Tax (FY2025) | ₹48,151 crore |

| Assets Under Management (AUM) | ₹54.52 lakh crore as of Mar 31, 2025 |

| Number of Policyholders | Over 29 crore (approx. figure) |

| Branches | Over 2,000 offices nationwide |

| Agents | More than 13 lakh agents |

| Email ID | co_crm@licindia.com |

| Customer Care Number | 022-68276827 |

| SMS Service | Send ASKLIC Policy Number to 9222492224 for policy info |

| Global Presence | Also operates in Fiji, Mauritius, Singapore, Nepal, etc. |

Types of Life Insurance Plans Offered by LIC

Now that you know about the LIC of India, it's time to talk about the different types of plans offered by LIC to get a better understanding.

LIC Endowment Plans

These are simple life insurance plans that help you save money. You get a big amount either when the plan ends or if something happens to the person insured. There are various types of lic endowment plans, like Bima Jyoti, New Endowment Plan, and more.

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC Bima Jyoti | Min: 90 DaysMax: 60 Years | Min: 1,00,000Max: No Limit | Non-linked, non-participating | Guaranteed lump sum payment at maturity |

| LIC Bachat Plus | Min: 90 DaysMax: 65 Years | Min: 1,00,000Max: No Limit | Non-linked, non-participating | Loyalty additions; early surrender allowed |

| LIC New Endowment Plan | Min: 8 YearsMax: 55 Years | Min: 1,00,000Max: No Limit | Non-linked, non-participating | Settlement option; riders available |

| LIC New Jeevan Anand | Min: 18 YearsMax: 50 Years | Min: 1,000,000Max: No Limit | Non-linked, non-participating | Loan facility; endowment + whole life combo |

| LIC Single Premium Endowment Plan | Min: 90 DaysMax: 65 Years | Min: 50,000Max: No Limit | Non-linked, participating (single payment) | Lump-sum maturity or death benefit; loan available |

| LIC Jeevan Lakshya | Min: 18 DaysMax: 50 Years | Min: 1,00,000Max: No Limit | Non-linked, participating | Annual income benefit; maturity lump sum |

| LIC Jeevan Labh | Min: 8 YearsMax: 59 Years | Min: 2,00,000Max: No Limit | Non-linked, participating (limited pay) | Bonus rebates for higher sums; limited payment term |

- 01

LIC Bima Jyoti

This is a simple life insurance and savings plan for one person. It is not linked to the stock market and does not give bonuses, but it helps you save money while also giving life cover. If something happens to you during the policy term, your family will get the full amount.

You can choose a policy term of up to 20 years.The minimum sum assured is ₹1 lakh.You can buy this plan if you are between 90 days old and 60 years of age. - 02

LIC Bachat Plus

LIC Bachat Plus is a life insurance plan that gives strong support to your family if something happens to you. If you stay safe and healthy till the end of the policy, you will get a lump sum (big) amount as a return. This plan is flexible in which you can either pay the full premium at once or pay it over 5 years, whichever suits you best.

You can pay the premium one time or over a 5-year period.A lump sum amount is given either to your family (if you pass away) or to you (if you stay healthy till maturity).Good option for people looking for both protection and savings in one plan. - 03

LIC New Endowment Plan

This plan gives money to your family if something happens to you before the policy ends. If you stay safe and healthy till the end, you will get a lump sum amount. It also helps with money needs during the policy through a loan (credit) option. Since this plan shares in LIC's profits, you may also get a bonus.

You can choose a policy term between 12 to 35 years.The minimum sum assured is ₹1 lakh, and there is no maximum limit.You can pay the premium monthly, quarterly, half-yearly, or yearly as per your choice. - 04

LIC New Jeevan Anand

LIC New Jeevan Anand is a life insurance plan that gives both protection and savings. If you stay healthy till the end of the policy, you will get a lump sum amount. If something happens to you during the policy period, your family will receive the full cover amount plus bonuses. You can also take a loan if you need money during the policy term.

Policy term options range from 15 to 35 years.There is no limit on the maximum sum assured.You can add extra safety with the Accidental Death and Disability rider. - 05

LIC Single Premium Endowment Plan

This is a one-time payment plan that gives both protection and savings. If something happens to you during the policy term, your family will get money. If you stay healthy till the end, you will get a lump sum amount. You may also get bonus money depending on LIC's profits.

You pay the premium only once at the start.Policy term options range from 10 to 25 years.You can also get a loan on this policy if needed. - 06

LIC Jeevan Lakshya

LIC Jeevan Lakshya is a life insurance plan that gives both savings and protection, and also provides a yearly income to support your family, especially your children. Whether you stay healthy or something happens to you, a lump sum amount will be paid at the end of the policy. You can also take a loan if you need money during the policy period.

You get a 10% yearly income (of the basic sum assured) if the policyholder passes away.Policy term options are from 13 to 25 years.Pay premiums monthly, quarterly, half-yearly, or yearly. Get discounts of 2% (annual) and 1% (half-yearly) on the premium amount. - 07

LIC Jeevan Labh

LIC Jeevan Labh is a life insurance plan that helps you save money and also gives protection. If something happens to you before the policy ends, your family will get money. If you stay healthy till the end, you will get a lump sum amount. This plan also gives bonuses based on LIC's yearly profits. You can even take a loan if you need money during the policy.

The minimum sum assured is ₹2 lakh.You can buy this plan after turning 8 years old.The policy ends by the time you turn 75 years old at most.

LIC Whole Life Plans

As the name says, this plan gives life cover for the entire lifetime of the person. When the person passes away, their family gets the death benefit along with any bonuses earned during the policy. Some whole life insurance plans are:

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC's Jeevan Umang | Min: 90 DaysMax: 55 Years | Min: 2,00,000Max: No Limit | Non-linked, non-participating, whole-life | Annual survival benefit of 8% of Basic Sum Assured post-pay term + loan facility |

| LIC's Jeevan Utsav | Min: 90 DaysMax: 65 Years | Min: 5,00,000Max: No Limit | Non-linked, non-participating, whole-life | Guaranteed additions ₹40 per ₹1,000 SA & lifelong annual income of 10% SA |

- 01

LIC Jeevan Umang

LIC's Jeevan Umang is a life insurance plan that gives you both protection and yearly payments. You pay the premium regularly for a set number of years. After that, if you're still alive, you start receiving money every year. At the end of the policy, you also get a big one-time payment (called maturity benefit). If you want, you can also add extra coverage for accidental death.

The plan gives coverage for your whole life, which means your family stays protected for many years.Once the premium payment term is over, LIC gives you a part of the total insured amount every year.You can also take a loan from LIC using this policy, once it builds enough value. - 02

LIC Jeevan Utsav

LIC's Jeevan Utsav is another life insurance plan that supports your family if something happens to you. You pay for a few years, and after that, if you're alive, LIC starts giving you regular income every year. You can choose to receive this income every year or save it to get more later. At the end of the policy, you get a big one-time payout (maturity benefit). This plan lets you add coverage for accidental death.

After you finish paying all premiums, LIC gives you 10% of the insured amount every year.You can choose a Flexi Income option, where you either take the yearly income or save it and earn interest at 5.5% per year.You can add extra protection by choosing from 5 optional add-ons (riders) for accidents, disabilities, etc.

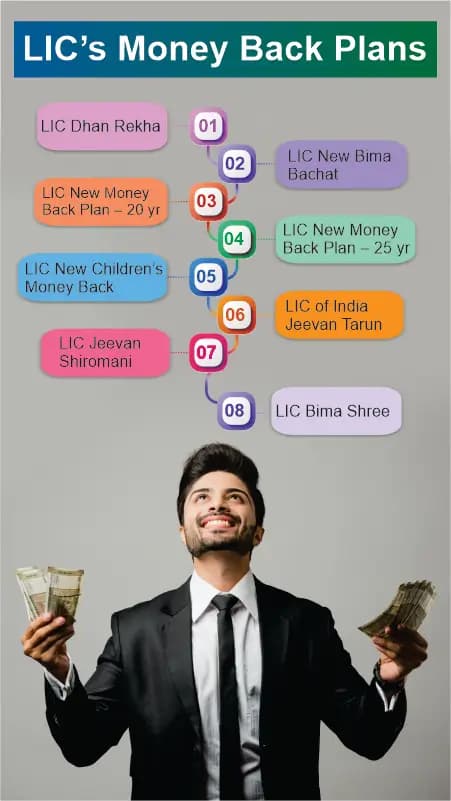

LIC's Money Back Plans

LIC's Money Back Plans give you money at regular intervals while your policy is active. If you live through the full policy term, you will also get the remaining amount at the end. If something happens to you during the policy period, your family will get the full sum assured, even if you already received some money earlier.

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC Dhan Rekha | 8 years for policy term 20 years3 years for policy term 30 years90 days for policy term 40 years | Min: 2,00,000Max: No Limit | Non-linked, limited-premium | Survival benefits; guaranteed additions; Accidental Death & Disability, Term Assurance, Critical Illness |

| LIC New Bima Bachat | Min: 15 yearsMix: 50 years | Min: 35,000 for 9 years50,000 for 12 years70,000 for 15 yearsMax: No Limit | Non-linked money back, single premium | Money-back payouts every 3 years from 3rd year (15%); full death benefit; loan facility. |

| LIC New Money Back Plan - 20 yr | Min: 13 yearsMix: 50 years | Min: 1,00,000Max: No Limit | Non-linked, participating, limited premium | Survival benefits; maturity 40% + bonuses; death benefit. |

| LIC New Money Back Plan - 25 yr | Min: 13 yearsMix: 45 years | Min: 1,00,000Max: No Limit | Non-linked, participating, limited premium | Survival at 5-yr intervals; maturity and death benefits with bonuses; riders available. |

| LIC New Children's Money Back | Min: 0 yearsMix: 12 years | Min: 1,00,000Max: No Limit | Non-linked, participating children's money-back | Maturity BSA + bonuses at 25; death benefit; loan facility; Premium Waiver Rider. |

| LIC of India Jeevan Tarun | Min: 90 daysMix: 12 years | Min: 75,000Max: No Limit | Participating, limited-premium child plan | Annual survival benefit from age 20; maturity plus bonuses at 25; death benefit floor; Premium Waiver Rider. |

| LIC Jeevan Shiromani | Min: 18 yearsMix: 55 years | Min: 1,00,00,000Max: No Limit | Non-linked, limited-premium, high-sum money-back | Survival payouts during policy; maturity & death benefits + Loyalty Additions; inbuilt Critical Illness benefit; loan facility |

| LIC Bima Shree | Min: 8 yearsMix: 55 years | Min: 10,00,000Max: No Limit | Non-linked, participating, medium-term money-back | Survival payments; maturity & death benefits; settlement options; loan facility |

- 01

LIC Dhan Rekha

LIC's Dhan Rekha is a life insurance plan that offers both protection and savings. If something happens to you during the policy term, your family gets a lump sum amount. If you stay alive, you get a guaranteed payout at the end of the policy.

You get fixed amounts at regular intervals during the policy if you're alive.You can also take a loan against this policy if needed.This plan is good for people who want life cover along with fixed savings. - 02

LIC New Bima Bachat

LIC's New Bima Bachat is a money-back plan where you pay the premium only once at the beginning. If something happens to you during the policy, your family will get the full insured amount. If you stay alive till the end, LIC will return your full premium plus a bonus.

You pay only once for the whole policy.Get some money back during the policy if you're alive.At the end, get your full money back along with a loyalty bonus. - 03

LIC New Money Back Plan - 20 yr

This plan provides life protection and also returns money at regular intervals. If something happens to the person during the policy, the family gets a big payout with bonuses. And if the person lives through the full 20 years, they get money back every few years, plus a final amount at the end.

Protect your family if something happens to you during 20 years.Gives you money every 5 years while you're alive.At the end of 20 years, you get a big amount with bonuses. - 04

LIC New Money Back Plan - 25 yr

This is a 25-year insurance plan that gives regular money back and protects your family if something happens to you. You also earn bonuses based on LIC's profits. If you complete the full term, you get a lump sum with bonuses at maturity.

Give money back at fixed intervals if you're alive.Offers full protection to your family in case of your death.At the end of 25 years, you get a large payout with bonuses. - 05

LIC New Children's Money Back

LIC's New Children's Money Back Plan is designed to help parents or grandparents save for a child's future needs like education and marriage. You can buy this plan for a child aged between 0 to 12 years. If the child is alive at the ages of 18, 20, and 22, LIC will give 20% of the insured amount at each of these ages. Along with these benefits, the plan also provides life insurance protection throughout the policy term.

You get money when the child turns 18, 20, and 22 years old.Gives life insurance cover for the child during the policy term.A good plan to save for your child's education or marriage. - 06

LIC of India Jeevan Tarun

LIC Jeevan Tarun is a plan made to support the growing needs of children, especially for their education. It gives both savings and protection. After the child turns 20, LIC will give a certain amount of money every year. You can choose how much you want to receive during the policy. If the child lives till the end of the policy, a big amount is paid as maturity benefit. This plan is flexible and helps you plan your child's future well in advance.

You get a 10% yearly income (of the basic sum assured) if the policyholder passes away.Policy term options are from 13 to 25 years.Pay premiums monthly, quarterly, half-yearly, or yearly. Get discounts of 2% (annual) and 1% (half-yearly) on the premium amount. - 07

LIC Jeevan Shiromani

LIC Jeevan Shiromani is a money-back life insurance plan made for people who can invest a large amount, with the minimum sum assured starting from ₹1 crore. It gives you regular payouts during the policy term if you stay alive. You only need to pay the premium for a limited number of years. After one full year of the policy, you can also take a loan based on the terms and conditions. It's a strong plan that combines life cover with regular financial returns.

Gives money back at different stages during the policy.You pay premiums for a few years, not the whole term.You can take a loan after one year if needed. - 08

LIC Bima Shree

LIC Bima Shree is a high-value life insurance plan made for people who want to secure their family's future and grow their wealth. It provides money-back benefits at regular stages and gives a big final payout at the end of the policy if the person is alive. This includes the sum assured along with Guaranteed Additions and Loyalty Additions. It's a great plan for those who want strong financial protection and the benefit of saving a large amount over time.

Gives regular payouts during the policy term.Big final payout at the end with extra bonus amounts.Offers strong life insurance cover and savings in one plan.

LIC Term Assurance Plans

LIC Term Assurance Plans are simple life insurance plans that give financial protection to your family if something happens to you during the policy period. These plans are low-cost and do not offer money back if you survive the term. They are mainly taken to ensure your family is safe and supported in case of your sudden death. It's a good option for people who want high life cover at an affordable price. Here are some LIC term assurance plans that you can choose:

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC Tech Term | Min: 18 yearsMax: 65 years | Min: 50,00,000Max: No Limit | Pure Term (Level or Increasing Sum Assured) | Choose regular, limited, or single premium mode, Death benefit = higher of 7x annual premium, Option to add Accident Benefit Rider |

| LIC Jeevan Amar | Min: 18 yearsMax: 65 years | Min: 25,00,000Max: No Limit | Pure Term (Level or Increasing Sum Assured) | Select payment mode: single, regular, or limited, Death benefit options: level or increasing (10% annual raise to 15th year), Available Accident Benefit Rider |

| LIC Saral Jeevan Bima | Min: 18 yearsMix: 65 years | Min: 5,00,000Max: 25,00,000 | Pure Term (Level Sum Assured) | Choose single, limited (5/10 yrs), or regular premium, Simple death benefit = highest of 10× annual premium, 105% premiums, or sum assured, Online discounts, covers COVID-19, short waiting period |

- 1

LIC Tech Term

LIC Tech Term is a life insurance plan that you can buy online only. It helps your family by giving them money if something happens to you during the policy period. Since it's online, there are no agents or middlemen.

If the person who bought the plan dies within 12 months of restarting the policy by suicide, LIC will only return 80% of the premiums paid.Offers two cover options: Level Sum Assured (fixed amount) or Increasing Sum Assured (grows with time).Available for people aged 18 to 65 years, with coverage up to 80 years. - 2

LIC Jeevan Amar

LIC Jeevan Amar is a pure protection plan that gives money to your family if you pass away during the policy term. You can choose how you want the money to be paid, either a fixed amount or an amount that increases every year. You can pay premiums in 3 ways: all at once (single), monthly/yearly (regular), or for a short time (limited).

You can also decide whether your family gets the money all together (lump sum) or in monthly payments.If you don't like the policy, you can cancel it within 15 days and tell LIC why.Lower premium rates are available for non-smokers and women. - 3

LIC Saral Jeevan Bima

LIC Saral Jeevan Bima is a simple and easy life insurance plan that gives only death cover. It helps your family if you die during the policy term.

If the person dies within 45 days (waiting period) due to an accident, the full sum assured will be paid.If the death is not from an accident, LIC will return all the premiums paid.After 45 days, full cover applies for all types of deaths.

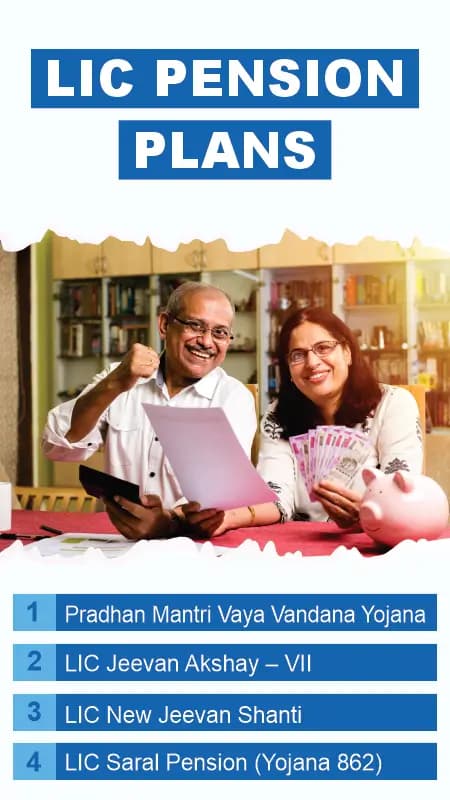

LIC Pension Plans

These are special plans from LIC that help you save money for your life after retirement. When you stop working, these plans give you money regularly, like a monthly income so you can take care of your expenses even when you're not earning. Here are some amazing LIC pension plans that you can consider:

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| Pradhan Mantri Vaya Vandana Yojana | Min: 60 yearsMax: No limit | Depends on the minimum premium | Government-backed senior citizen pension | Guaranteed 8% p.a. pension for 10 yearsFlexible payout: monthly, quarterly, half-yearly, or yearlyLoan allowed after 3 years up to 75% of investment |

| LIC Jeevan Akshay - VII | Min: 30 yearsMax: 85 years | Depends on the minimum premium | Immediate annuity plan | Single premium, no medical examChoice of 10 annuity options (e.g., lifelong, return of purchase price)Guaranteed income instantly after purchase. |

| LIC New Jeevan Shanti | Min: 30 yearsMix: 80 years | No Limit | Single premium deferred annuity | Guaranteed annuity after deferment periodChoice between single or joint life annuity Higher rates for larger investments (₹5 L+) |

| LIC Saral Pension (Yojana 862) | Min: 40 yearsMix: 80 years | No Limit | Pure Term (Level Sum Assured) | ixed lifelong pension; single or joint-life with purchase price return Flexible payout: monthly to annualLoans can be taken after 6 months; tax benefits under 80C/10(10D) |

- 1

Pradhan Mantri Vaya Vandana Yojana

This is a special pension scheme started by the Government of India for senior citizens. You pay a lump sum amount, and in return, you get a fixed monthly pension. The pension amount is decided every year by the Ministry of Finance. This plan is only for people above 60 years of age and was extended for 3 more years starting in 2020.

You pay a one-time amount and receive a fixed monthly pension.The pension amount is decided every year by the Ministry of Finance.Only available to people above 60 years of age, and it has been extended for 3 more years from 2020. - 2

LIC Jeevan Akshay - VII

In this plan, you pay once and get a pension for your entire life. You can choose from 10 different pension options based on your need—like getting pension monthly, quarterly, half-yearly, or yearly. You can buy this plan online or from an LIC office. The pension amount stays fixed and will never change.

You make a one-time payment and receive a pension for life.You can choose how often you want to receive the pension (monthly, quarterly, half-yearly, or yearly).The pension amount remains fixed and will not change. - 3

LIC New Jeevan Shanti

This is a pension plan where you can choose to get a pension either just for yourself or for both you and your spouse. You pay once, and the pension starts after a fixed wait time (called deferment). After that, you'll get a regular income for life. If something happens to you during the wait time, your family will get benefits.

You can choose to get a pension just for yourself or for both you and your spouse.You pay once, and the pension starts after a fixed waiting period.If something happens to you during the waiting time, your family gets benefits. - 4

LIC Saral Pension

This is a simple pension plan that works the same way in all insurance companies as per IRDAI rules. You pay a lump sum amount once and choose to get regular income for life. You can take this plan for yourself or for yourself and your spouse.

You pay a lump sum amount and receive a regular pension for life.You can buy this plan for yourself or for you and your spouse.If you or your spouse fall seriously ill, you can cancel the plan and get your money back after 6 months.

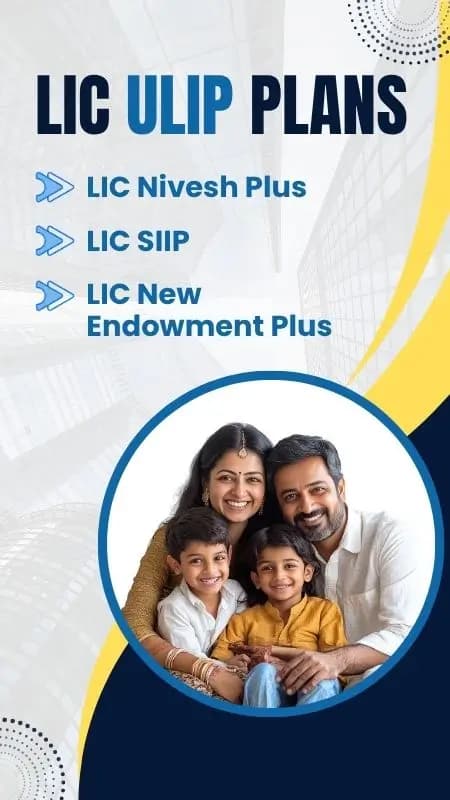

LIC ULIP Plans

ULIP stands for "Unit Linked Insurance Plans". These plans give you both life insurance and a chance to invest. In this type, the part of the money you pay goes towards life insurance, and the rest is invested in stocks or bonds. Keep in mind that the investment part has some risks because it depends on the market. Here are some of the best LIC ULIP plans you can choose from:

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC Nivesh Plus | Min: 90 daysMax: 70 years | Option 1: 1.25 times of single premiumOption 2: 10 times of single premium | ULIP (Unit Linked Insurance Plan) | Offers both life insurance and investment options.Investment in equity, debt, or a mix.Flexible premium payment options (Regular, Limited, and Single). |

| LIC SIIP | Min: 90 daysMax: 70 years | Below 55 years: 10 times of Annualised premiumsAge 55 years and above 15 times of Annualised premiums | ULIP (Unit Linked Insurance Plan) | Linked to stock market performance.Flexible investment options: equity, debt, or balanced.Life cover with the option to increase or decrease coverage. |

| LIC New Endowment Plus | Min: 90 DaysMix: 50 years | 10 times of annualized premiums | Endowment Plan (with investment) | Combination of insurance and investment.Participates in corporation's profit.Provides risk cover along with wealth creation. |

- 1

LIC Nivesh Plus

LIC Nivesh Plus is a plan that gives both insurance and investment coverage. You pay a single premium, and in return, you get life insurance for the whole term. You can choose the amount of insurance you want when you start the policy. You also have the option to invest in one of four different types of funds.

You only need to pay once at the start and there is no need to pay again later.You get both life insurance and a chance to grow your money.You can switch between different investment funds during the policy. - 2

LIC SIIP

LIC SIIP is a plan that offers both life insurance and investment protection. You can pay premiums regularly (monthly, quarterly, half-yearly, or yearly) and choose from four types of investment funds. You can also change your payment frequency in the future. This plan is available both online and offline.

You can pay regularly, monthly, quarterly, half-yearly, or yearly.You get to pick how your money is invested (equity, debt, or mix).You can increase or decrease your insurance cover after starting the plan. - 3

LIC New Endowment Plus

LIC New Endowment Plus is a plan that combines life insurance with investment. It's designed to help you save for the future while keeping your insurance coverage. You can invest in different types of funds, and the value of your investment can go up or down based on the performance of the fund.

You get life insurance plus investment benefits.Your investment value goes up or down depending on the fund's performance.You can choose who gets the money if something happens to you (nominee).

LIC Micro Insurance Plans

LIC micro insurance plans are made to help people with low income get life insurance. These plans are simple and affordable so that more people can stay protected. Here are the types of micro insurance plans offered by LIC. Let's take a closer look on some micro insurance plans:

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC Bhagya Lakshmi | Min: 18 yearsMix: 55 years | Min: 20,000Max: 50,000 | Term Assurance + Return | Term insurance plan with 110% return of premiums on maturity.Fixed policy term of 5 to 15 years.Ideal for low-income women and families. |

| LIC New Jeevan Mangal | Min: 18 yearsMix: 55 years | Min: 10,000Max: 50,000 | Term Assurance | Life cover with flexible premium payment (single or regular).Optional accident benefit rider.Policy term: 10 to 15 years. |

| LIC Micro Bachat Plan | Min: 18 yearsMix: 55 years | Min: 50,000Max: 2,00,000 | Endowment Assurance | Savings + life insurance benefit.Maturity benefits with loyalty additions.Policy term: 10 to 15 years, premium paying same as policy term. |

- 01

LIC Bhagya Lakshmi

LIC Bhagya Lakshmi is a plan that gives both life insurance and helps you save money. If the policyholder passes away during the policy, their family will get a lump sum amount. You can choose to pay the premium yearly, half-yearly, quarterly, or monthly, whichever is more comfortable for you.

Gives life insurance and returns 110% of your paid premiums if you stay healthy till the end.You can choose to pay premiums monthly, quarterly, half-yearly, or yearly.The plan is simple and made for low-income families, especially women. - 02

LIC New Jeevan Mangal

LIC New Jeevan Mangal is a plan made to protect your family. It also includes accident cover, which means if the policyholder dies in an accident, the family gets double the insured amount. If you miss a premium, the policy stays active for a short time (grace period), but it will stop if the payment is not made before the grace period ends.

Gives life cover, and if death is due to an accident, the payout is doubled.You can pay the premium once or regularly based on what suits you.Even if you miss a payment, the policy stays active for a short grace period. - 03

LIC Micro Bachat Plan

LIC Micro Bachat is a simple plan that gives you both savings and life protection. If something happens to the policyholder during the policy period, their family gets financial help. If the policyholder stays healthy and completes the plan, they also get a maturity amount as savings.

Gives both savings and life insurance in one plan.You get loyalty additions (extra bonus) at the end if you stay in the plan.Fixed premium term, usually same as policy term (10 to 15 years).

LIC Withdrawn Plans

LIC used to offer many different plans for people from all parts of the Indian economy. These plans are no longer available now. Here's a list of the LIC plans that have been stopped. Let's take a quick look at different LIC withdrawal policy.

| Plan Name | Age (Min & Max) | Sum Insured (Min & Max) | Coverage Type | Policy Features |

|---|---|---|---|---|

| LIC Jeevan Arogya | Min: 18 yearsMix: 65 years | No Limit | Health Insurance Plan | Provides daily hospital cash benefits.Covers major surgeries with lump sum payouts.Can cover spouse, children, and parents under one plan. |

| LIC Cancer Cover | Min: 20 yearsMix: 65 years | Min: 10,00,000Max: 50,00,000 | Cancer-Specific Insurance | Covers both early and major stages of cancer.Waiver of premium on early diagnosis.Fixed benefits paid regardless of actual medical bills. |

- 01

LIC Jeevan Arogya

LIC Jeevan Arogya is a health insurance plan that helps you during medical emergencies. It gives money support when you or your family are sick or need surgery. In jeevan arogya policy of LIC amount you pay (premium) depends on your age, gender, and the type of cover you choose.

Give daily cash if you're admitted to the hospital.Covers major surgeries and gives a lump sum amount.Covers major surgeries and gives a lump sum amount. - 02

LIC Cancer Cover

LIC Cancer Cover is a health plan that helps you if you're ever diagnosed with cancer. It gives financial support during both early and major stages of cancer. You pay the premium regularly, and the amount stays fixed for the first 5 years. After that, LIC may change the premium based on their experience.

Gives a fixed amount if you're diagnosed with early or major stage cancer.Premium stays the same for the first 5 years.If cancer is diagnosed early, you don't have to pay future premiums (premium waiver).

Who Should Buy LIC Plans?

LIC (Life Insurance Corporation of India) plans are great for anyone who wants to secure their future and protect their loved ones financially. These plans are suitable for:Young Professionals

If you're just starting your career, this is the best time to invest in LIC. You get lower premiums and build a strong financial foundation for your future goals like buying a house or starting a family.

Parents

If you have children, LIC plans help you save for their education and marriage. It also gives your family financial protection if something unexpected happens to you.

Working Individuals

Whether you're salaried or self-employed, LIC plans help you save regularly and offer life cover. They're a smart way to combine savings with insurance.

People Nearing Retirement

LIC also offers pension and retirement plans. These plans give you regular income after retirement so you can live stress-free in your golden years.

Taxpayers

LIC premiums qualify for tax benefits under Section 80C of the Income Tax Act. So if you're looking to save on taxes, LIC of India plans can help you in this.

Anyone Who Wants to Save and Stay Safe

Even if you're not sure about investments, LIC plans are simple, safe, and reliable. It's a trusted option for long-term savings with guaranteed returns.

How to Choose the Right LIC Plan for Your Needs

LIC offers many types of plans. To pick the right one, you need to think about your goals, your age, and your budget. Here' how you can choose the best LIC plan for yourself:

- 1

Know Your Purpose

Ask yourself:Why do I want to buy an LIC plan?Is it to:Protect your family if something happens to you?Save money for your child' future?Get regular income after retirement?Save tax?Your reason will help you choose the right type of plan.

- 2

Check Your Age and Life Stage

Your age plays an important role in selecting the right plan.If you&apor;e young, you can choose long-term plans with low premiums.If you&apor;e a parent, you may want a child education or money-back plan.If you&apor;e close to retirement, you can go for pension or annuity plans.

- 3

Decide Your Budget

Think about how much money you can pay every month or year. LIC offers both low-premium and high-benefit plans. Choose a plan that fits your pocket.

- 4

Compare Different Plans

LIC has different plans like:Term Plans - Pure protection at a low costEndowment Plans - Insurance + SavingsMoney Back Plans - Regular payouts during the policy termPension Plans - For retirement incomeChild Plans - To secure your child' future and more.Read about them and pick the one that matches your needs.

- 5

Talk to an LIC Agent or Use the Website

If you&apor;e still confused, don&apot; worry. You can:Talk to a trusted LIC agentUse the LIC website to compare plansRead brochures or ask questions before buying.

What is the LIC Calculator and How Does it Work?

The LIC Calculator is a free online tool provided by LIC of India. It helps you find out how much money you need to pay for your LIC policy and how much you will get in return at the end. You can use this tool to:

Check your premium (the amount you need to pay)See the total amount you&apol;l get when the policy endsChoose how you want to pay: monthly, every 3 months, every 6 months, or yearly

It also helps you change the plan to match your needs and budget. This way, you can easily pick the best LIC plan for yourself.Now, how does it work?

Ankit is 30 years old and wants to protect his family' future. So, he decides to buy three LIC plans - LIC New Jeevan Anand, LIC Saral Jeevan Beema, and LIC Jeevan Lakshya.

These plans will help him save money and also give protection to his loved ones. Based on Ankit's age, the policy details, and the sum assured, here is how much premium he has to pay:

| Name | Age | Policy Name | Policy Term | Sum Assured | Total Premium |

|---|---|---|---|---|---|

| Ankit | 35 years | LIC New Jeevan Anand | 15 years | Rs. 1,00,000 | Rs. 8,444 (Includes tax of Rs. 364) |

| Ankit | 35 years | LIC Saral Jeevan Beema | 20 years | Rs. 5,00,000 | Rs. 23,966 (Includes tax of Rs. 3,656) |

| Ankit | 35 years | LIC Jeevan Lakshya | 25 years | Rs. 1,00,000 | Rs. 4,562 (Includes tax of Rs. 196) |

How to Buy LIC Insurance Policies in India Online

Buying an LIC policy online is simple. Just follow these easy steps:

- Step 1

Go to the official LIC of India website.

- Step 2

Choose the plan you want and click on Buy Online.

- Step 3

Fill in your basic details like your name, date of birth, and phone number.

- Step 4

Select how much money you want to insure (sum assured), how long you want the plan (policy term), and how often you want to pay (monthly, yearly, etc.). You can also add extra benefits called riders for more protection.

- Step 5

Pay the premium online. After payment, LIC will send your policy details and receipt to your email.

LIC Claim Process in Life Insurance

Claim settlement is an important part of the service LIC provides to its customers. LIC tries to make sure that maturity and death claims are handled quickly and smoothly. Here's how the process works:

Maturity Claims

If you have an Endowment policy, LIC pays the policy amount at the end of the policy term. About two months before the due date, the LIC branch sends a letter to inform you about the payment. To receive the payment, you need to send back:A completed Discharge FormThe Policy DocumentBank account details with proof (NEFT form)KYC documents (ID, address proof, etc.)Once these are received, LIC processes your payment so that the amount is credited to your bank account on the due date.Some plans like Money Back Policies pay you money from time to time (like every few years). If the payment is Rs. 5,00,000 or less, you don't need to send any documents. The money is paid directly.For Jeevan Anand policies, if the amount is Rs. 2,00,000 or less, you also don't need to send the policy bond or discharge form. If the amount is more than these limits, LIC will ask for the discharge form and policy bond before releasing the money.

Death Claims

If the person who had the policy sadly passes away during the policy period, the person named in the policy (called the nominee) can claim the money. Here's how:Inform LIC (Claim Intimation) The nominee should tell the nearest LIC office or call LIC customer care as soon as possible. LIC will then give the Death Claim Form to fill out.Submit Documents The nominee needs to collect and submit the required documents at the LIC branch.Claim Check (Verification) LIC will check the form and documents. If needed, they may ask for more details or investigate to understand the cause of death.Payment (Claim Processing) If everything is correct, LIC will approve the claim and transfer the money directly to the nominee's bank account.

Documents Required for LIC Claim Process

Now, let's know some important documents that you need to submit while making a claim for your LIC life insurance.

For Maturity Claims

To get your LIC maturity money, keep these documents ready:Filled policy discharge form (LIC will give you this)Original policy papersID proof (like Aadhaar card, PAN card, etc.)Address proof (like electricity bill, Aadhaar card, etc.)Age proof (if not already given before)NEFT form with your bank account detailsA cancelled cheque or a copy of your bank passbook

For Death Claim

To get the LIC death claim, the nominee needs to give these documents:Original policy papersID proof of the nomineeNEFT form with bank account detailsForm D - employer certificate (if the person was employed)Form C - certificate of identity and cremation/burialCancelled cheque or copy of bank passbookForm B and B2 - filled by the doctor who treated the personCopy of FIR / Police Report / Post-mortem Report (if applicable)Form 3801 - discharge formDeath Claim Form A (from LIC office or website)Form B1 - if the policyholder was admitted to the hospitalAddress proof of the nomineeDeath certificate from local government office

FAQs

The amount you get depends on your policy type, the premium you paid, the sum assured, and bonuses added over the years. For example, in an endowment or money-back plan, you may get the sum assured + bonuses. You can ask your LIC agent or check your policy documents for an exact figure.

In a term insurance plan, if the policyholder is alive after 20 years, no money is paid because it only covers death during the policy period. But if the person dies within 20 years, the nominee gets the sum assured.

The maturity amount is calculated as:

- Sum Assured + Bonuses (like Simple Reversionary Bonus & Final Additional Bonus)

- You can check the LIC website or talk to your LIC advisor to get an estimate based on your policy.

In Jeevan Anand, after 20 years, you usually get:

- Sum Assured + Bonuses

- However, the exact amount depends on your premium, sum assured, and declared bonuses over time. Plus, the life cover continues even after maturity, for lifetime coverage.

It's a 20-year Money Back Policy with 75% of the sum assured paid back in parts during the policy term. The rest is paid at the end with bonuses. For example:

- 15% paid at 5th, 10th & 15th year

- Remaining 45% + bonuses paid at the end (20th year)